Summary:

This class is sometimes referred to, “Growth vs. Value, Large vs. Small, What to Make of it All?”. Here we will discuss segmentations given to describe investments.Agenda:

- Investment Segmentation

- Cash

- Bonds

- Stocks

- Alternative Investments

- International Investing

- Examples

- Professional Categorizers

- Recap

1. Investment Segmentation

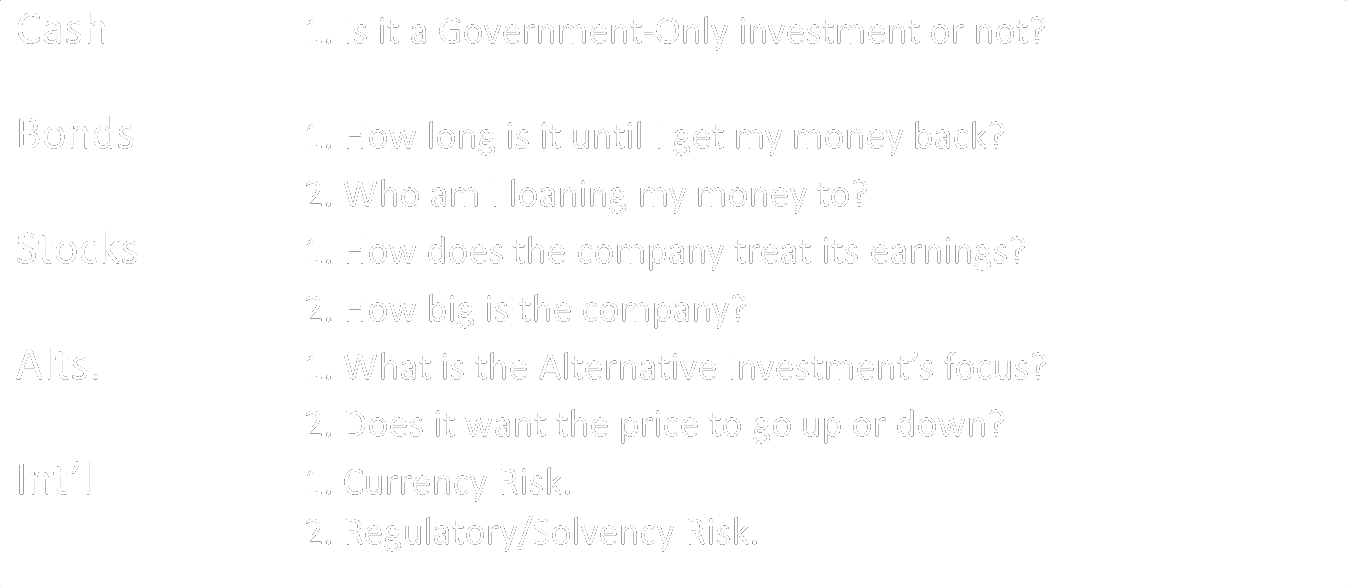

Understanding what an investments’ intent, risks, and potential rewards are is a crucial step before putting money into any investment. Oftentimes, it is important to contrast investments to one another to better understand how one does in light of the intent, risk, and potential rewards it takes on. To help with this, investments are categorized and then further segmented. We’re going to start by giving you some key questions to help further segment each of the broad category of investments we discussed in Class 203 – “Investment Categories”.

A. Cash

Earlier we defined four broad investment categories, now we will briefly showcase segmentation of these categories. We will start with Cash as it’s the simplest. In the 401(k) world, a 401(k) cash investment will likely be called a “Money Market”, and there are generally only two kinds of Cash Investments: government only and non-government only. Thus the question here is simply, is my 401(k) cash investment government only or not? The difference is simply how restrictive the investment’s mandate is on the permissibility of short term debt issued by sources other than the federal government. Of the two, non-government only is the more common variety.

Government only money market securities would only permit treasury bills and federal agency notes. As the name implies, if it isn’t issued by the U.S. Government or its agencies, it isn’t permissible.

In contrast, non-government only money market securities include Treasury bills (Treasury Bills being federal government issued debt with a maturity of 90days or less), federal agency notes, commercial paper (Commercial paper is an IOU issued by a company that needs money in the short term to finance accounts receivable, inventories, or other short-term needs), Certificates of Deposits (commonly called CDs), and repurchase agreements.

That said, both forms of cash investments are considered to be the least risky form of investing common to 401(k)s, so in either case when it comes to your 401(k), use Cash Investments when you need to minimize risk because of your age and risk tolerance, but don’t use cash just because you are scared! Your use of cash needs to be strategic, not emotional, when it comes to 401(k) investing.[a]

B. Bonds

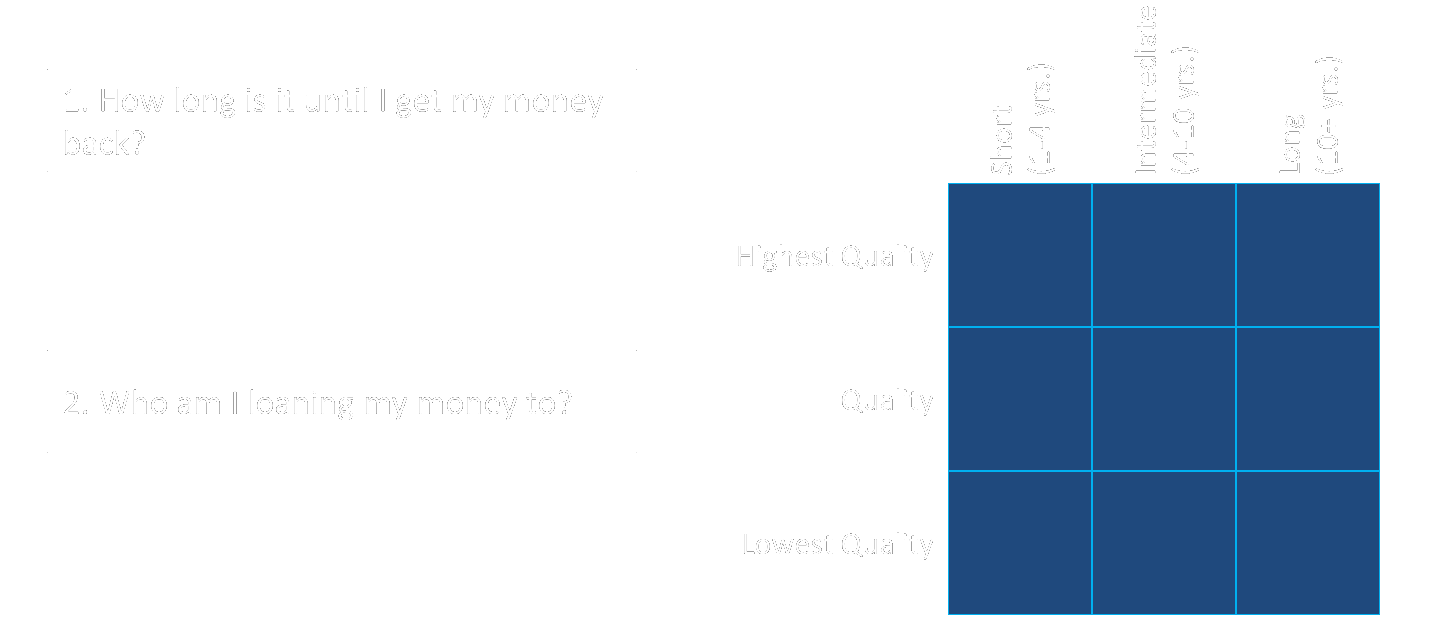

Recalling our earlier discussion of Bonds in Class 203 – “Investment Categories”, bonds are essentially loans, or I.O.U’s. Thus, there are two key questions to ask of a bond investment to quickly and efficiently segment it.

1) How long is it until I get my money back? To give an allegory, if you loan a friend $1,000 for a day, that’s one thing, but if the same friend asks for $1,000 for a year, that’s different. The longer it is until you get your money back, the greater the risk is. Back to Bond investments, this could be because interest rates go against you and the bond you had for 3% could now instead be earning 5%, thus making your 3% loan less attractive, or the greater the opportunity for something to go wrong and make it so you never get your money back. In bonds, the time until you get your money back is measured by “Maturity”, or when a bond pays you back your principal investment. They are generally segmented as Short, Intermediate, or Long term bonds. While the specific definition of what constitutes short, intermediate, or long is up to the investment itself, generally, a Short term bond has a maturity of 1 to 4 years, an Intermediate term bond has a maturity of 4 to 10 years, and a Long term bond has a maturity of 10 or more years.

2) Who am I loaning my money to? This is the deciding factor in terms of repayment risk, or “will I get my money back?”. Pretend your child ask you for $20 to setup a lemonade stand. You think to yourself, “Wow, how enterprising”, and give your child the $20. Your child purchases lemons, sugar, cups and a pitcher, builds a stand, and gets to work. Then, seeing this, your other child ask for $20. Sighing inwardly, you agree. “To be fair,” you tell yourself. Hours later, your child returns from a day’s work with $25. In contrast, you have to physically catch your other child, now on a sugar-high from all the soda and candy she bought at the convenience store up the street. After scolding your other child, you manage to recover $10.

Knowing who you are loaning your money to is crucial. In example, the U.S. government, and thus, “government” bonds, are considered to be without risk in terms of repayment. Other countries’ governments that have robust economies are very nearly so as well, but others, not so much. Corporations, meanwhile, are less secure, and smaller, riskier corporations even less so. The same applies to municipalities, such as states versus counties. Generally speaking, bonds are divided into what are called, “Government”, “Investment Grade”, and “Non-Investment Grade” bonds, often called “Junk” bonds. This measures the risk that the issuer will default on the loan and not pay you back in full. This isn’t to say that Junk bonds always default on their loans, as there are many wonderful companies that are expertly run in this space that repay their bonds to a T, but it is an acknowledgment that a junk company may not be as able to repay as another company.

If you were to use these two questions to segment bonds, we would make a picture out of it, and it would look something like the image below. The least risky bond in this depiction is the Short “Government”, or Highest Quality, bond. The most risky is the Long “Junk”, or Lowest Quality, bond. That said, remember that bonds are categorically less risky than investments such as Stocks or Alternative investments as bonds represent a loan, not ownership. While some stock investments may be less risky than a Long Junk bond, categorically, bonds have less risk, and accordingly, less reward.[b]

C. Stocks

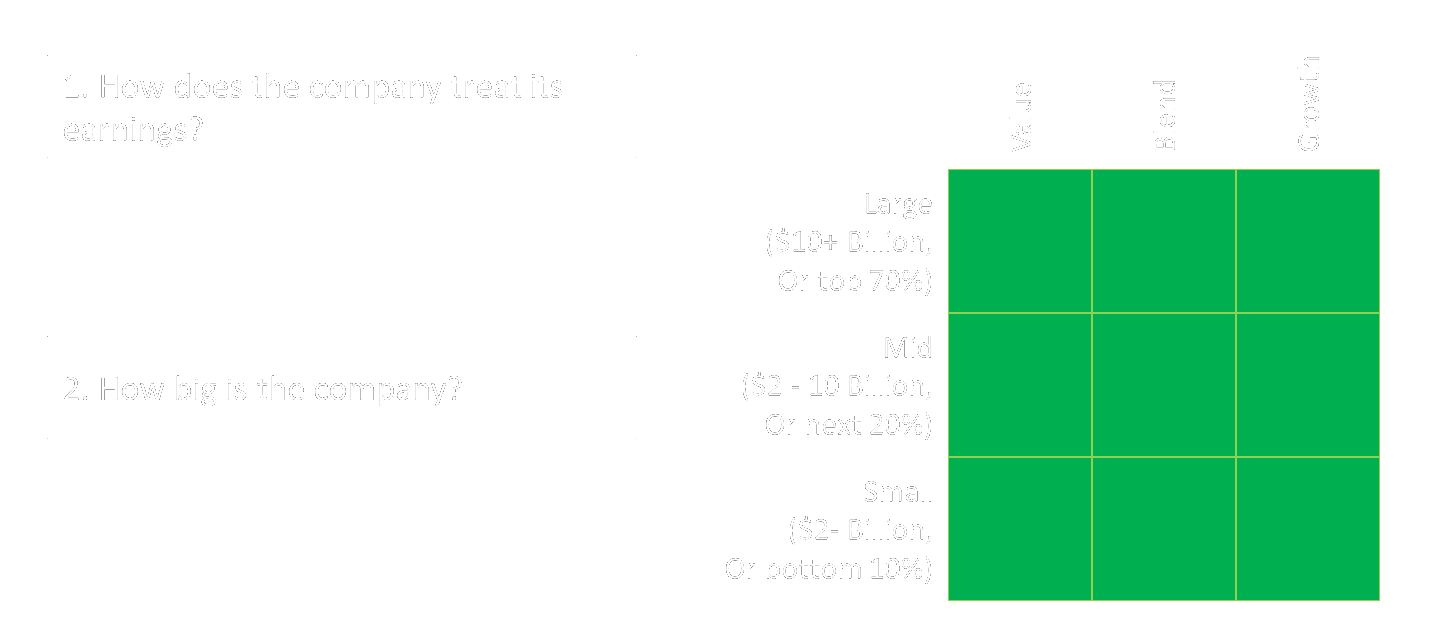

Once again recalling our earlier discussion of Class 203 – “Investment Categories”, this time with Stocks, Stocks are essentially ownership of a company. Thus, there are two key questions to ask of a Stock investment to quickly and efficiently segment it.

1) How does the company treat its earnings? The answer to this is indicative of whether the company is “value” oriented, or “growth” oriented. Value investing focuses on finding companies who are priced below their intrinsic value, or, put simply, companies that are on sale. Value companies tend to pay a portion of their earnings out as cash to their owners. These cash payments are called dividends. In contrast, growth investing looks for companies whose earnings are growing faster than that of their competition. Growth companies tend to reinvest their earnings into themselves to give them a continued edge in outpacing their competition. If a company doesn’t have a strong aspect of either value or growth, it is considered to be a blend of these, and is labeled as such.

2) How big is the company? This is another important consideration, as larger, more established companies are seen as having a greater ability to withstand hard economic times with their deeper cash reserves. In contrast, small companies have fewer restraints on them, allowing them to innovate, and, ideally, grow faster. While it is, once again, up to the investment itself to decide what constitutes a Large stock investment versus a Small stock investment, it is generally segmented by Market Capitalization, or the total dollar amount of all shares outstanding multiplied by the price of those shares, with Large companies being $10+ Billion, Mid companies being $2-10 Billion, and Small companies being $2 Billion or less. That said, this obviously changes as time goes on. In 1950, as an example, $1 Billion would likely have been a Large company. Thus another mindset on the matter is that Large is the top 70% of market capitalization in a geographic area, like the United States, Mid being the next 20%, and Small being the last 10%.

If you were to take these two questions and make a picture out of it, it would look something like the image below. Now, when it comes to Stock investing, every piece of it is risky. While some will say that Large Value is seen as the least risky, whereas Small Growth would be the most risky, at the end of the day, every one of these segments has High risk and High reward.[c][d]

D. Alternative Investments

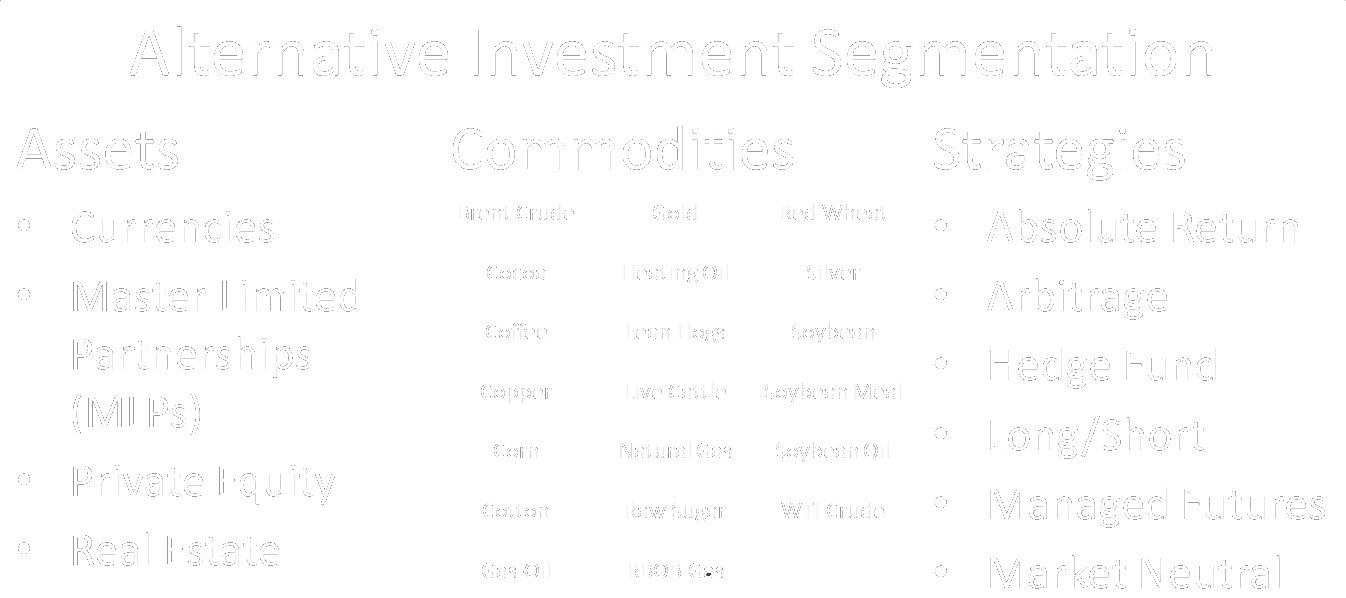

Finally, we have Alternative Investments. Whereas stock investing represents ownership in a company, alternative investing often represents ownership of raw, physical goods. That said, Alternative Investments represent the broadest array of segmentations and can run the gamut of investments from gold, currencies, investment strategies, to land, and more. Thus, more so than any category prior, it’s important to dig in to Alternatives and ask good questions. Start by asking a simple one, such as, “Does my 401(k) have Alternative Investments?” Sadly, Alternatives Investments are missing from many 401(k) plans altogether! If this is true of your 401(k), ask the people in charge of your 401(k) a second question, that being, “Why don’t I have this important category of investments as an option?” Now, returning to segmentation…

1) What is the Alternative Investment’s focus? An alternative investment will likely fall into one of the following segmentations: assets, commodities, or a strategy.

a. Assets are something you own, such as basket of currencies including the Japanese Yen, a Master Limited Partnership in oil/gas pipelines across America, the stock of private companies, or real estate in the U.S.A. or abroad. Thus, owning assets has risk akin to stocks, being that you physically own something whose value changes, but the price of Alternative Assets tends to change for different reasons from stocks. Therefore, owning Alternative Assets also helps to diversify your portfolio.

b. Commodities are real assets you can take physical possession of, and, the harbinger back to the days of bartering. That said, no one really takes possession of, say, 500 lean hogs these days, but it’s interesting to know you technically can. Commodities have risk akin to stocks, in that you do physically own something whose value changes daily, but unlike stocks, the price of a commodity tends to move up or down for different reasons than stocks. Thus, commodities also help diversify your portfolio.

c. Finally, there are strategy driven Alternative Investments. There are many such strategies, and, often, these are blended together. Strategy driven alternative investments seek to profit regardless of the direction of price changes in their focus. To know more about that, we need to know the answer to the second question.

2) Does my investment want the price of its focus to go Up, to go Down, or does it think it can make money regardless of the price? This is another important consideration, as with more sophisticated strategies, it’s possible to make money when something goes Down in price! It’s important to note that the standard operation of investments is that they want their focus to go Up in Price. That’s how the sweeping majority of investments work. Now, when this is not true, you will see specific words in the investment’s title to clue you in. Each of the sample Strategy Alternative Investments is an example of this. Of these, the Long-Short is the easiest to grasp, so we’ll use it as an example. “Long” means it wants the object of its focus to go Up in price, whereas “Short” means it wants the object of its focus to go Down in price. Thus, a Long-Short investment has a focus it is “Long” on, and it wants those to go Up in price. It also has another focus that it is “Short” on, and it wants this second focus to go Down in price. Absolute Return and Market Neutral are kindred in that they utilize instruments to seek profit regardless of the direction of the movement in the price of their focus. Unlike Long-Short investments, which tend to focus on stocks, Absolute Return and Market Neutral tend to feature more diversity. There are too many strategies to list them all, so we’ll cut it short and say that strategy driven alternative investments are also something whose price changes daily and who tend to move up or down for different reasons from stocks, thus, strategy driven alternative investments help diversify your portfolio.

Due to its wildly divergent nature, it’s much harder to put a pretty picture or grid to the Alternative category. Thus, we utilize our 3-part segmentation shown above for Alternatives. In terms of risk and reward, Alternative Investments are generally akin to stock investing in that they have High risk and reward, but because they tend to move up or down for different reasons, they help diversify your portfolio.[e]

E. International Investing

As a subset of Bond, Stock, and some Alternative investing, it’s important to note that it is possible to do International investing with these. While the United States is a nation of hundreds of millions of people, the world is populated with billions of people, and there is a whole wide world of investing to do outside the United States!

International Investing has its own set of risks. We are going to highlight two key risks here:

1) Currency Risk

If you make an investment in your 401(k), it will be made in U.S. dollars because you are paid in dollars. If you make an investment in an instrument that is also based on US Dollars, such as a U.S. Government Treasury Bill, then you are perfectly insulated from Currency Risk. However, if you invest in a Japanese Government issued bond with U.S. Dollars, you will be subject to currency risk, and the exchange rate of Dollars to Yen will affect the overall return of your bond investment at maturity.

Likewise, if you were to invest in the ABC Large Japanese stock investment instead of the ABC Large US stock investment, the exchange rate of Dollars to Yen will again affect the overall return of your investment. To negate this risk though, an investment may “hedge” itself via futures or other instruments. This pre-arranges the conversion of Dollars to Yen, or protects it, and thus, removes Currency Risk from the list of risk factors that may affect you. Thus, when evaluating an International investment, be sure to learn what currency the investment will be made in, and, if it is in non-U.S. Dollars, learn whether or not it is hedged. If it is hedged, Currency Risk won’t affect you, but if it is not, it will. In fact, you may desire an investment that is not hedged to further diversify yourself beyond just the U.S. Dollar! Currency risk isn’t necessarily a bad thing. Like other risks, you just need to weigh it against your overall tolerance for risk and desire for potential rewards.

2) Regulatory/Solvency Risk

At this point in time, the United States has the largest and most liquid investments in the world. It also has a long history of investment review and regulation to protect you as an investor. When investing in international investments though, this may not be as true. While certain nations, such as England or Germany, also have very large, liquid, and well regulated investments, other nations are much newer to this. Thus, it’s important to understand that international investing may have geographic, military, political, and/or regulatory risks that simply do not exist in the United States. As a result, International investing can be riskier than investing at home in the U.S.A., but, conversely, International investing can also be more rewarding than investing in the U.S.A.

In properly diversifying yourself, you do want to have investments from outside the Unites States. Be aware that international investing carries these extra set of risks, but with the demographic growth outside of the United States, the rewards more than offset this. More so, properly diversifying yourself with both U.S. and International investing has been shown to lower the overall risk of an investment portfolio, so be sure that you have International investments in your Bond, Stock, and Alternative Investments![f][g]

2. Examples

Now that you’ve seen the various segmentations of investment categories, let’s try out a few examples to see how well the information stuck with you. We’ll be putting up hypothetical investment names, and you try to categorize them, estimate their risk/reward, and segment them! For bonus points, see if you can also identify the investment firm, geography, and the desired movement for the price of the investment.

Category?

Risk/Reward?

Segment?

Investment Firm?

Geography?

Desire for Price?

A. ABC International Large Value.

B. XYZ Intermediate Government.

C. XYZ Long-Short Commodities.

D. ABC Money Market.

E. ABC Global Real Estate.

And here are the answers:

a. The Category is Stock, the Risk/Reward is High, the Segment is Large Value, the Investment Firm is ABC, the Geography is International, meaning non-U.S. companies, and the Desire for Price is Up.

b. The Category is Bond, the Risk/Reward is Low, the Segment is Intermediate Government, the Investment Firm is XYZ, the Geography is U.S., and the Desire for Price is Up. It’s important to note though that most Bond investments derive the majority of their returns through their Income, not through movement to their price though.

c. The Category is Alternative Investments, the Risk/Reward is High, the Segment is Commodities, the Investment Firm is XYZ, the Geography is Not Applicable, and the Desire for Price is both Up & Down, hence the “Long-Short”. This one had 3 trick questions in it. First, it had 2 segments. Second, geography is not applicable to commodities as gold is gold no matter where it is in the world. Third, due to its Long-Short segmentation, it’s desire for Price is both Up & Down. Note that this hypothetical investment is a Long-Short of commodities, and thus, would provide diversification to an investment portfolio despite being a Long-Short investment. Not all Long-Short investments focus on stocks, but most do.

d. The Category is Cash, the Risk/Reward is Minimal, the Segment is Non-Government Only, the Investment Firm is ABC, the Geography is U.S., and the Desire for Price is Flat. Cash investments seek to maintain an even price throughout their history. They provide return through their minimal income.

e. The Category is Alternative Investments, the Risk/Reward is High, the Segment is Real Estate, the Investment Firm is ABC, the Geography is Global, which includes U.S. investments, and the Desire for Price is Up.

3. Professional Categorizers

What we have taught you so far will be helpful in better understanding what your investment choices hope to accomplish with their strategies. Understand though that this is akin to deriving information about a book by its cover. It’s important to know that this is not sufficient to make an investment decision, but rather to gain an understanding of the investment’s intents. From here, more diligent research is needed.

To facilitate this, and to stay on top of the ever changing world of investments, it’s important to know resources for this purpose. One such resource is www.Morningstar.com. Morningstar is a company whose full-time job is categorizing, segmenting, and further researching investments. If you intend to be a “Let Me Do It” investor, this is a powerful resource for you to know!

4. Recap

In summary, there are a many segmentations of investment categories! The purpose of this class is to help you see them and have a better feel for differences in a Large Value US investment and a Long-Short Commodity investment. The questions to ask or risks to consider are recapped here.

Disclosures

[a] Government bonds and Treasury bills are guaranteed by the U.S. Government as to the timely payment of principal and interest, and, if held to maturity, offer a fixed rate of return and fixed principal value.

[b] Bonds are subject to market and interest risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

[c] Stock investing involves risk including loss of principal.

[d] The prices of small and mid-cap stocks are generally more volatile than large cap stocks.

[e] Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

[f] International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

[g] There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Congratulations! This concludes your Advanced curriculum! This means you’ve finished everything we have to offer you as a employee at this time, so take a moment to celebrate your newfound knowledge, and after that, it’s time to apply it!

Tracking #1-168592