Summary:

Now that we know the most important factor toward making a 401(k) successful, we can discuss other parts that factor in to that benefit as well.

Agenda:

- Overview

- 401(k) & the Car: A Parallel Continued

- You as an Investor

- “Do It For Me”

- “Help Me Do It”

- “Let Me Do It”

- Recap

1. Overview

Here then is the topic that generates the greatest sum of discourse when it comes to 401(k). Whether it is related to the stock markets, the bond markets, commodities, fees, legislation, regulation, or a bevy of other topics, it all seems to swirl around 401(k) investments. Remember though, the most important factor in determining the success of your 401(k) is not to be found here in investments. Class 101 – “How Much Should I Contribute to My 401(k)?” and its topics hold more important information than what is discussed below. That’s not to say that what is below isn’t important, but always remember the importance of contributions.

Investing is a challenging subject for many people as it is something that is known to be important, but that few of us have ever had any education on. As such, we will be discussing investments not from a technical perspective, but from a behavioral perspective.

2. 401(k) & the Car: A Parallel Continued

Returning to our parallel with 401(k) & the Car, if the 401(k) is like a car, and contributions like gas (fuel is more appropriate, but let’s keep it simple), then investments are like the engine. Much like investments, people’s discussion of engines generates a lot of discourse. In addition, people’s interest in engines varies greatly. Most people know that the engine is important to get around, but not many change their own oil, and even less have ever taken their engine apart to rebuild, retune, or improve it. Most people are drivers, while others are engine enthusiasts, and small portion are gearheads.

Each of these have a parallel in 401(k) investments. Rather than try to teach everyone how to build an engine from scratch, this class will focus on providing the information to help each type make better choices. Just like with engines, remember that it behavioral investing is not a progression. One doesn’t graduate from driver to engine enthusiast to gearhead. Not everyone needs to change their own oil or be confident in disassembling their engine to successfully use a car.

3. You as an Investor

Using the engines parallel as a guide, thinking of yourself as an investor and ask yourself the following question, “When it comes to me and investing, I would rather my 401(k)”:

B. Help Me Do It. I have a plan and a goal that I will execute on, but I would like a sounding board to help me consider my options. I will pull the trigger and be responsible for executing though.

C. Do It For Me. I have not the time, inclination, or knowledge to execute on this for myself. It’s not to say that I can’t, but rather that I have more important things in my life, so if a trusted source presented itself, I’d like them to handle this and free my life up for what really matters.

Looking over these three options, most people feel like they should be “A. Let Me Do It”. However, by behavior, the sweeping majority of people are “C. Do It For Me”. People feel like they need to exhibit the traits shown in “A. Let Me Do It” because they know investments are important, but something very shocking has revealed itself as time has borne on in 401(k), and that is that many times, those who are honest with themselves and use the options designed for “C. Do It For Me” outperform those who fool themselves into thinking they are “A. Let Me Do It” or “B. Help Me Do It”.[1]

Furthermore, this is not a progression system. One doesn’t graduate from C. to B. to A. It’s about who you are as an investor, and many of us would rather do anything on the weekend than read financial reports! Be honest with yourself and be who you are! A tremendous amount of time and energy has been spent in developing powerful investments specifically for those who are “C. Do It For Me”.

4. “Do It For Me”

The sweeping majority of people are this type of investor, and that’s great. Accordingly, a tremendous amount of time and energy has gone into developing tools for just this group.

Thinking aloud, the best investment for people in this group would be one that handles the core principles of managing investments for the investor. Specifically, one that:

B. It would also Rebalance to keep the pie chart on track as things fluctuate.

C. Most important of all, it would Reallocate the user’s pie chart to increase exposure to ‘Less Risky’ assets as one gets closer to one’s goal of retirement.

Wouldn’t this be great? An investment that takes all of the heavy lifting and will “Do It For Me”. Well thankfully, a category of investments happens to have been designed just for this purpose. The investments that fall in this category are called “Target Date Retirement funds”. In fact, let’s look at a hypothetical one now.

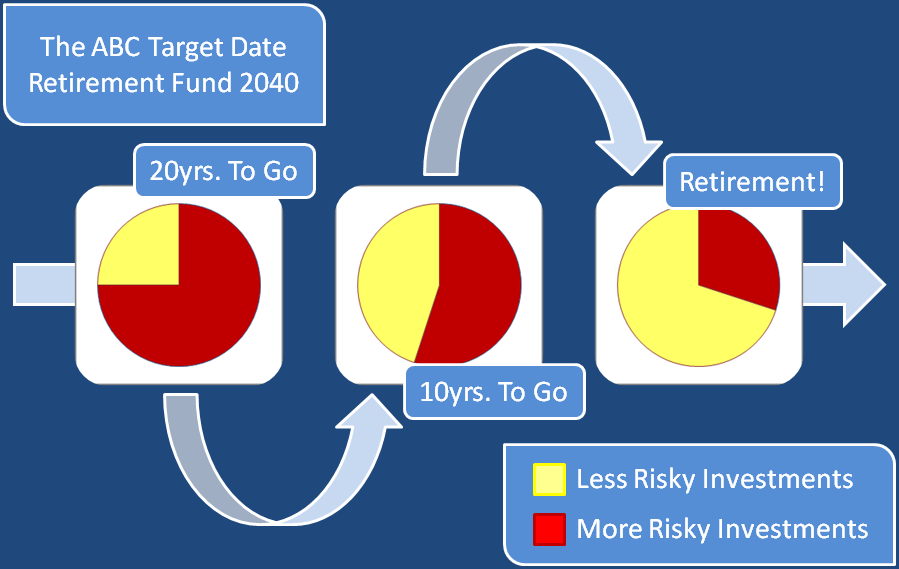

The goal of any Target Date Retirement Fund is to help you achieve your goal of retirement in the namesake year of the fund. In this case, the Goal is retirement in the year 2040, as identified in the name, The ABC Target Date Retirement Fund 2040. This year should correspond right around to year you reach retirement age, say, 67.

What we see is that the farther out we are from retirement, the more Red, or ‘More Risky Investments’ there are, and the closer we are to retirement, the more Yellow, or ‘Less Risky Investments’ there are. While the ABC Target Date Retirement Fund 2040 is simply a hypothetical, this is how Target Date Retirement Funds operate as a category. In so doing, they are able to satisfy the 3 crucial pieces of investment management for the goal of retirement mentioned above.

As you look at the time spectrum in the picture, you can see the transformation from ‘Growth’ to ‘Moderate’ to ‘Conservative’ as your ability to handle risk changes. This is how Target Date Retirement Funds are designed specifically for “Do It For Me’s”. You focus on what really matters in life, and the Target Date Retirement Fund handles your retirement monies for you. This makes investing a lot easier.

Note that these funds are designed to be your sole investment; 100% of your allocation.[a]

In closing, ask your Plan Advisor or HR group about the “Do It For Me” options your plan has. You might even find that these are the default investment option for your plan.

5. “Help Me Do It”

For those who feel that “Help Me Do It” best describes them, reach out to your 401(k) plan’s education support team. Likely, this is your 401(k)’s Plan Advisor, but it could be the 401(k) provider itself. Talk things through with them, bounce ideas around, and be sure to educate yourself. Remember, your goal is to test your investment strategy ideas out and know how it deals with the following key areas:

B. Rebalancing to keep your pie chart on track as things fluctuate.

C. Most important of all, Reallocating your pie chart to increase your exposure to ‘Less Risky’ assets as you get closer to your goal of retirement.

Keep asking questions until you are satisfied! At the same time, after looking at all that goes into the 3 crucial steps in investing, you may decide to that “Do It For Me” is a better fit for your time after all.

6. “Let Me Do It”

For those who are in the “Let Me Do It” category, reach out to your plan sponsor, get the full range of investments, and have at it! Be sure to talk with your HR/Owner at the company and ask them if the plan offers options to give you greater access to investments. Some plans have much more restricted investment menus than others, while others offer complete open architecture to draw on thousands of options! Sometimes, all it takes to get a 401(k) provider to move to a platform that gives you more power is a nudge, so dig in and get that research going.

7. Recap

The most important aspect of investing is behavior, so be honest with yourself as an investor. Ask yourself the following question, “When it comes to me and investing, I would rather you (the 401(k)/plan advisor)”:

B. Help Me Do It.

C. Do It For Me.

The 401(k) is going to have options and resources to help each type of investor, so ask about them! Remember, this is not a progression system. One doesn’t graduate from C. to B. to A. It’s about who you are as an investor, and many of us would rather do anything on the weekend than read financial reports! Be honest with yourself, be who you are, and find the investments that suit you accordingly.

Disclosures:

[a] Investments in Target Date Retirement Funds are subject to the risks of their underlying funds. An investment in a Target Date Retirement Fund is not guaranteed at any time, including on or after the target date. Target Date Retirement Fund suggestions are based on an estimated retirement age of approximately 67. Should you choose to retire significantly earlier or later, you may want to consider a fund with an asset allocation more appropriate to your situation.

Sources:

[1] DALBAR Quantitative Analysis of Investor Behavior 2012, http://www.qaib.com/public/default.aspx.

Tracking #1-212833 & 1-098244