Summary:

Now that we know 401(k) lingo, history, and the general rule, we can wade a little deeper into the retirement waters.Agenda:

- Recent History

- The Private Pension

- When is Enough, Enough?

- Income Gap

- When is Enough, Enough? (today)

- When is Enough, Enough? (retirement)

- Needed Deferral %

- Recap

1. Recent History

In decades past, companies promised their employees a continuation of their current paycheck when they retired via a company pension. This made the transition to a comfortable retirement of life and leisure as simple as could be. When an employee had earned their pension and reached the time in their life when they were ready to transition, the pension took over for the paycheck, and life went on. Simple, right?

Unfortunately, there were significant perils in this approach that have come to light over the past decades. So great were these perils that they have caused this model to crumble and, today, virtually cease altogether. The greatest peril in this approach was that someone else was in charge of your comfortable retirement and your pension was subject to their financial risks. If something went very wrong for the company, it could mean the end of your pension, and thus, the end of your comfortable retirement!

This terribly rude awakening has played out for far too many unfortunate people, and so, in time, companies and people looked for a new way to ensure that the dream of a comfortable retirement of life and leisure wasn’t at risk from the outside. Thus, the 401(k) came about.

2. The Private Pension

By this point, we know that the purpose of a 401(k) is to help you to continue to have a paycheck after you stop working so that you can enjoy a comfortable retirement of life and leisure. The 401(k) works with you to support you in retirement. To accomplish this, your 401(k) must evolve to become “The Private Pension” for you. In short, your 401(k) must transition from a pool of money to the continuation of your paycheck. This then, is how we truly answer the question from Class 101 – “How Much Should I Contribute to My 401(k)?”. We determine what we need to do to help build your Private Pension.

3. When is Enough, Enough?

Our ultimate goal here is to tell you how much you may need to defer into retirement savings like your 401(k) each year to be successful in addressing your retirement goal. In Class 101 – “How Much Should I Contribute to My 401(k)?” we said that the general rule is 10%.

Here then is where we really go under the hood for retirement and answer the most important question in retirement, “When is Enough, Enough?”.

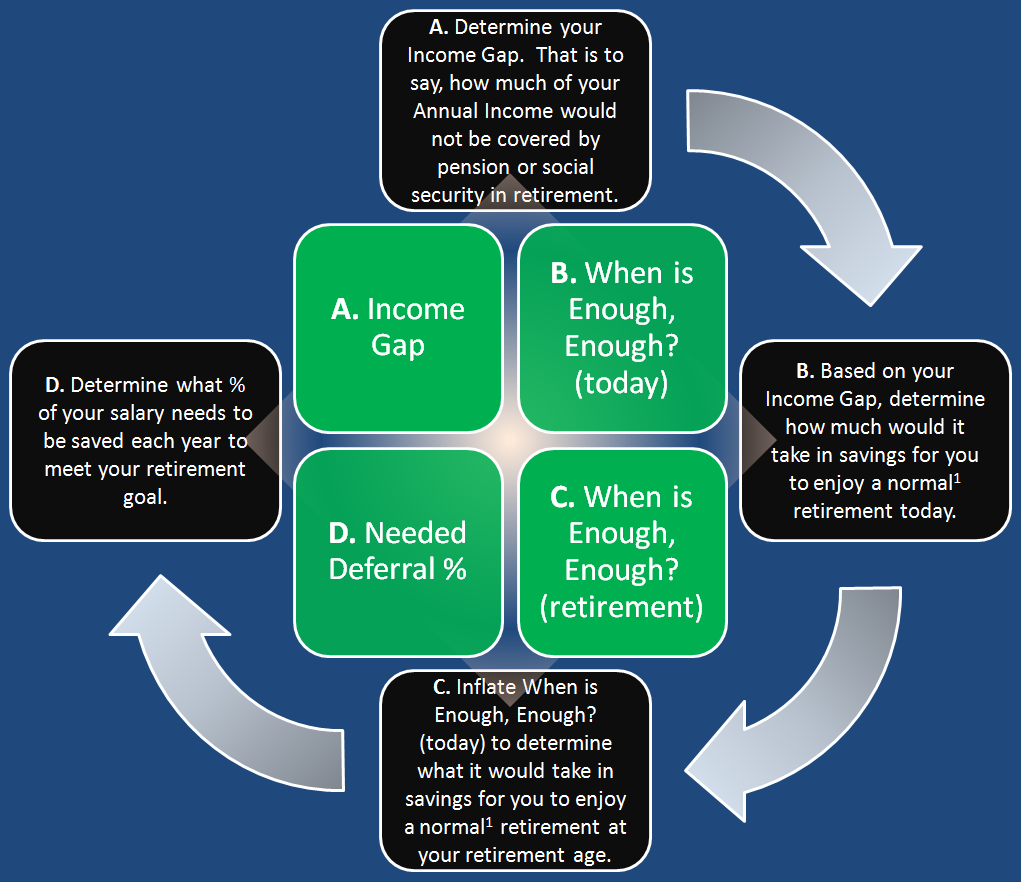

In order to answer how much you need to be saving today, we first start from today, work into the future, and then come back to today to bring it full circle. Here’s a visualization of what is happening, and we will expand on it below:

B. Calculate When is Enough, Enough? (today)

C. Determine When is Enough, Enough? (retirement)

D. Calculate Needed Deferral %.

4. Recap

In summary, the best answer to the question of When is Enough, Enough? is the answer you derive yourself! While the general rule discussed in Class 101 – “How Much Should I Contribute to My 401(k)?” suggest 10% as the guideline for pursuing your retirement goal, make use of our Retirement Calculator to help determine the exact number for your retirement goal!

Sources:

[1] Normal being defined as 30 years pursuant to mortality information from annuity tables by the Society of Actuaries.

[2] Fidelity Viewpoints, January 2013, “A key to a lasting retirement portfolio”, https://www.fidelity.com/viewpoints/key-to-lasting-retirement.

Tracking #1-212833 & 1-098244