Summary:

Now that you know what your Private Pension needs to be, let’s talk about investment strategies to help get you there!Agenda:

- Introduction

- Strategy & Vision, a Reminder

- 401(k) Investing Strategies

- Dollar Cost Averaging

- Asset Allocation

- Diversification

- Rebalancing

- Reallocation

- Recap

1. Introduction

Hopefully you have read through the investment basics of Class 102 – “What Should I Invest in with My 401(k)?”. If not, it is an excellent resource to understand the most significant variable in choosing 401(k) investment strategies, that being yourself! Always bear in mind that it’s important to be honest with yourself about how involved you want to be in investing. If you are not interested in being involved with the day-to-day decisions of investing, don’t be! There are wonderful options designed to handle the heavy lifting of investing for you.

That said, you are here in this class because you at least have the interest in understanding investing at a deeper level, so let’s dive in.

2. Strategy & Vision, a Reminder

“Victorious warriors win first and then go to war, while defeated warriors go to war first and then seek to win.” ~ Sun Tzu, Chinese General.

A strategy is a plan of action designed to achieve a vision. The vision, then, is the key to any strategy. The vision defines whether or not the strategy is ultimately successful. While this class will be focusing on the investing strategies the 401(k) was built upon, remember that no strategy can be successful without a vision. Our Retirement Calculator, referenced in Class 201 – “The Private Pension”, is there to help you build a clear vision of your retirement goal. If you haven’t already, take a moment to use these resources.

3. 401(k) Investing Strategies

There are a plethora of investing strategies out there. Just within 401(k), there are still a slew of investment strategies. What we will be discussing today are the five strategies that are at the core of Portfolio Theory.[1] The reason we will be discussing these is that Portfolio Theory was central to the design concepts of 401(k). Let’s identify these five strategies below:

A. Dollar Cost Averaging

As the 401(k) was built upon the premise of deferred compensation, participants automatically employ this strategy. Dollar Cost Averaging is the strategy that says by continuously purchasing into an investment over time, you reduce the stress you’d incur by otherwise attempting to time the market. Studies have shown that investors who endeavor to time the market end up consistently, and significantly, underperforming their peers who simply avoid this practice.[2]

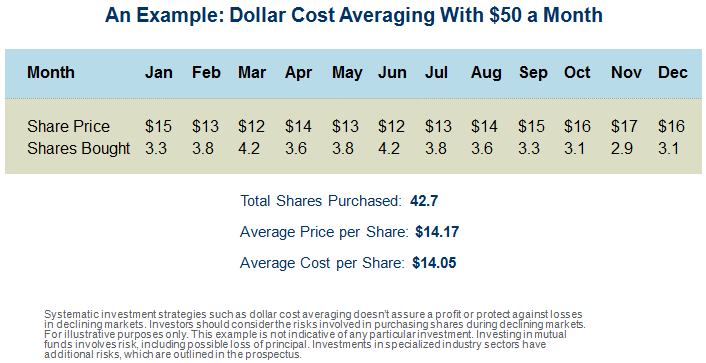

Here’s a visual of Dollar Cost Averaging in action:

If your only purchase was at the beginning of the year, it would be stressful to hold on in March, when things have declined 20% in just three months. With dollar cost averaging though, you simply keep plugging away, and in both March and June, make the most advantageous purchases you make all year.[a]

B. Asset Allocation

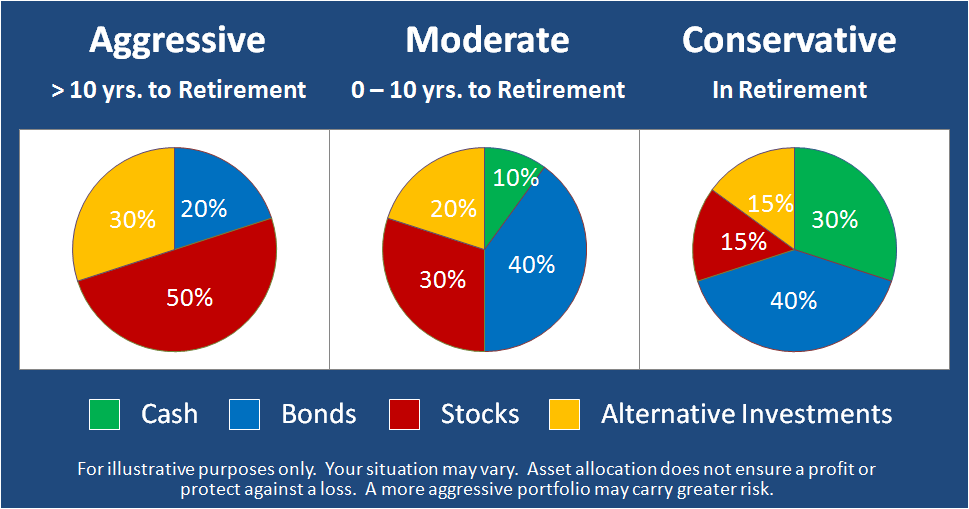

Asset Allocation is oftentimes portrayed as a pie chart of broad investments categories attuned to risk, like so:

What you see then is that by modifying the amount of exposure you have to more risky asset classes, such as stocks and alternative investments, versus less risky asset classes, such as cash and bonds, you can adjust the risk of your investments as a whole. This is the underlying premise of Asset Allocation. By correctly placing yourself at the risk level appropriate to your age, and thus, timeline to your goal of retirement, you give yourself a good chance to succeed at your goal by taking appropriate risk when you can and retreating from excessive risk as you get nearer your goal.[b]

NOTE: A follow-up, more detailed discussion about the broad level investment categories, cash, bonds, stocks, and alternative investments, will be given in Class 203 – “Investment Categories”.

C. Diversification

When it comes to investing we’ve all heard the expression, “Don’t have all your eggs in one basket”. This expression is speaking to the benefits of Diversification to help protect against the risk of catastrophic investment loss. By spreading money amongst multiple investments within a broad investment category (or even a single investment which itself invest amongst multiple investments), the theory is that should one of the investments suffer a loss, it will, ideally, be offset by gains from other, unrelated investments. Thus, Asset Allocation and Diversification work together as you choose the appropriate risk level for your situation and then diversify within each section of your pie chart.[c]

D. Rebalancing

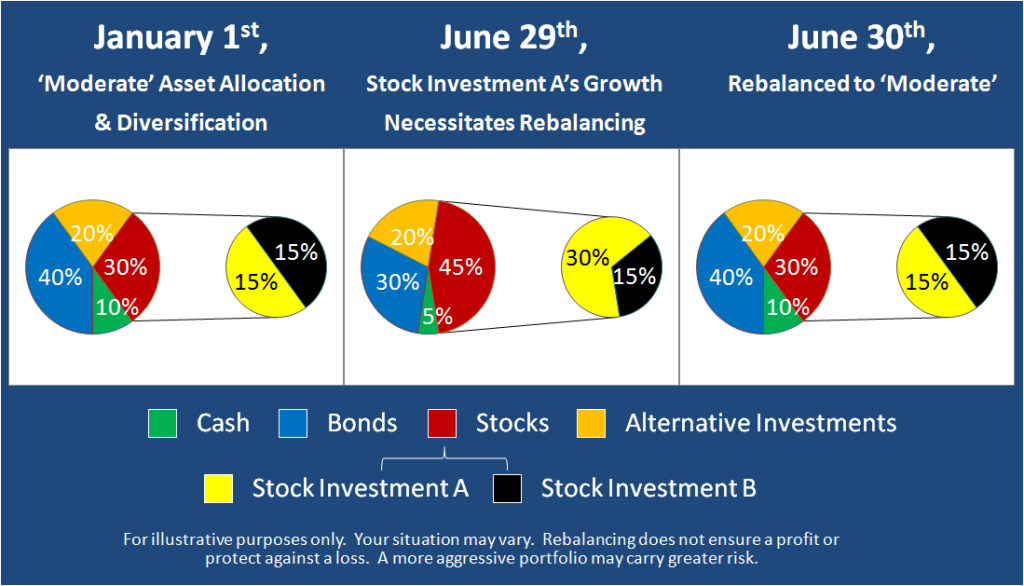

Rebalancing is an important part of Asset Allocation/Diversification. Rebalancing is the act of hitting the ‘reset’ button on your Asset Allocation/Diversification as the investments drift over time. It’s very easy to get caught up in euphoria or dread when it comes to investment returns. This is where you need to have the discipline to stick to your Asset Allocation/Diversification and control your risk. If you simply allow your winners to run away without reining them in, or you leave your losers down and never help them rise up, the overall risk of your investments will shift in ways that aren’t appropriate to your age. It’s crucial to go in twice per year and reset both your Asset Allocation and your Diversification.

Here we can see that because of the tremendous growth in Stock Investment A from January to June, the Asset Allocation and Diversification of the Stock category are significantly off target. This jeopardizes the intended risk of the portfolio, and so, to correct this, the portfolio needs to be rebalanced to its intended risk of ‘Moderate’. In this hypothetical example, by selling Stock Investment A, we are forcing ourselves to sell high, and with its proceeds, buy low into our other investments. As you have probably heard, when it comes to investing, you want to Buy Low and Sell High, which is exactly what Rebalancing forces you to do.[d]

E. Reallocation

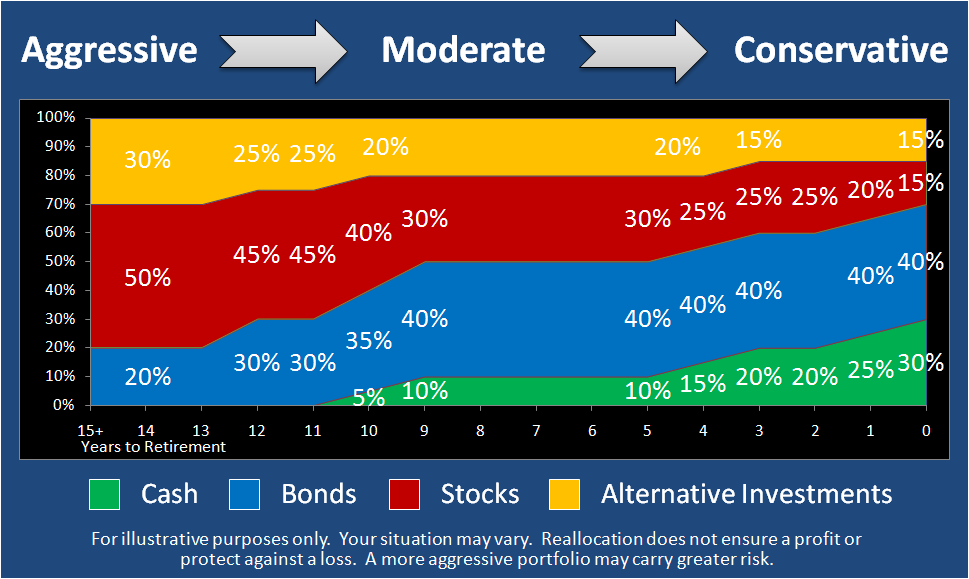

Reallocation then is the strategy of moving down the risk spectrum as your goal nears. It is, essentially, the practical application of Asset Allocation over time. Oftentimes it looks like this:

We can see that the Asset Allocation examples of Aggressive, Moderate, and Conservative are precisely where we’d expect them to be in this representation of Reallocation: left, middle, and right, respectively. Reallocation then is simply the process of transitioning from one to the other and smoothing the process out. Deciding when to start transitioning and how quickly to move from more to less risky investments is a subject of intense debate within the financial world at this time! If you have further questions about this, feel free to contact your 401(k) plan’s advisor to learn more![e]

4. Recap

While there are many powerful investing strategies out there, there are five that are central to the design of 401(k):

A. Dollar Cost Averaging. A strategy of continuous investment to avoid market timing and ensure that when markets dip, you continue to invest and make some advantageous purchases.

B. Asset Allocation. A strategy to control risk by selecting broad level investment categories based upon their risk and your timeline to retirement.

C. Diversification. A strategy to further control risk by selecting a multitude of investments (or an investment which itself selects a multitude of investments) within each broad category of investment to avoid catastrophic losses.

D. Rebalancing. A strategy to control risk by periodically ‘resetting’ Asset Allocation/Diversification. A byproduct of this strategy is that it helps force you to buy low and sell high.

E. Reallocation. The practical application of Asset Allocation/Diversification over time to ensure risk remains appropriate to your age.

We will dive deeper into investments in our next class as well!

Disclosures:

[a] Dollar cost averaging involves continuous investment in securities regardless of fluctuation in price levels of such securities. An investor should consider their ability to continue purchasing through fluctuating price levels. Such a plan does not assure a profit and does not protect against loss in declining markets.

[b] Asset allocation does not ensure a profit or protect against a loss.

[c] There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

[d] Tactical allocation may involve more frequent buying and selling of assets and will tend to general higher transaction cost. Investors should consider the tax consequences of moving positions more frequently.

[e] All examples are hypothetical are not representative of any specific investment. Your results may vary. No strategy assures success or protects against loss.

Sources:

[1] Modern Portfolio Theory, http://en.wikipedia.org/wiki/Modern_portfolio_theory.

[2] DALBAR Quantitative Analysis of Investor Behavior 2012, http://www.qaib.com/public/default.aspx.

Tracking #1-212833